Typically, a company’s CFO or senior financial executive is a fiscal-planning resource. He can contribute a comprehensive viewpoint and appreciation of the company’s financials. The CFO offers a clear view of the fully burdened cost of resources—including sellers and the return they provide—when analyzing sales expenses and those returns.

In many companies, senior leaders of operating departments, including sales leaders, don’t always have the full view of resource expenses in their P&Ls. The CFO, however, sees expenses as investments the company is making, with an expectation of the ROI. These fully burdened resource expenses are in a CFO’s full view, when expense or investment decisions are made.

When assessing the ROI on an expense, many sales leaders think exclusively about revenue returns. The CFO, on the other hand, will think in terms of increased revenue, decreased expense, and/or expense avoidance.

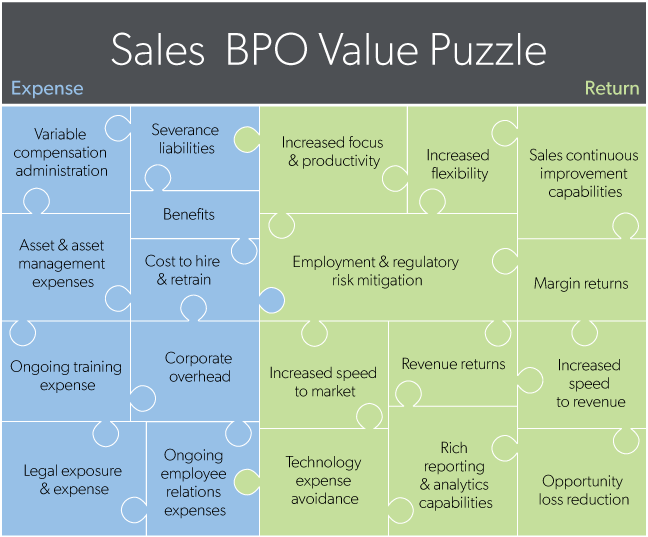

You can develop a strategy to optimize your sales expense and maximize your returns using several different approaches. Sales outsourcing is one such strategy, using high-value business process outsourcing (BPO), rather than offshoring. It often takes a CFO’s vision to combine all the puzzle pieces and create a full picture of the value a sales BPO strategy can provide.

There are two sides to this equation: the true expense side and the full return side. When analyzing the true expense, the CFO will include the applicable carrying expenses of an employee. These expenses will include both direct and indirect expenses, such as allocations of corporate overhead. In large organizations, the carrying cost of a sales employee can be more than 26 percent of his base salary. MarketSource has found the cost to be as much as three to five times the total compensation.

This is important when comparing internal expense to the resource expense in a sales BPO model. On the return side, the CFO will look at committed revenue attainment as well as expense savings or expense avoidance opportunities to calculate the full return.

These expense considerations include:

- Risk and liability expense avoidance

- Technology and other sales enablement expense avoidance such as CRM, LMS and other sales productivity technologies and their administration

- Reduced opportunity loss by increased speed to productivity and deployment flexibility

- Expense avoidance of new sales performance capabilities, including advanced coverage modeling and targeting, rich sales analytics, and formal continuous sales improvement

The CFO will assess these key areas and many more. If you are the senior financial executive in your company, dig into the powerful financial performance opportunity that sales BPO offers.

You can learn more about a sales BPO strategy from a MarketSource Assessment for your company. MarketSource’s sales experts will work with you to define your challenges and design a turnkey solution that produces results in the area of gaining new customers, launching new products, growing market share, optimizing sales expense, or maximizing a mature product.

Our sales teams deliver more than $6 billion in revenue for many of the most well-respected brands in the world and a diverse mix of forward-thinking small- and medium-sized businesses. You can learn more about this topic and MarketSource’s Proprietary Process, Empowered People, and Proven Performance, by contacting us today.