Why is the new market for selling smart home solutions meeting so many challenges to success? According to data from The Consumer Technology Association, the retail market of connected home devices has seen a steady stream of new smart system and device introductions. But moving forward, retail sales in this vertical are suffering growth pains due to

- The complexity of the systems

- Market fragmentation

- Slow consumer adoption

- Lack of in-the-aisle education

- Lack of consideration for customer lifestyle in the system presentation

To succeed at sales in a smart home solution, retailers must acknowledge and overcome each of these.

Selling through the complexities of the IOT and connected home systems

The idea of the “Holy Grail” of system solution sales is that the challenges of creating the perfect sales circumstance for this vertical appear nearly insurmountable. In fact, it is very difficult for retailers to set up and bring a whole system to life for a customer.

By connecting entire ecosystems like water quality, power consumption, and the morning commute, as described in this MIT-produced video, smart home solutions can display for consumers “an integrated approach to buildings and their interaction with occupants, (and) the local community, and beyond.”

Though forms of home automation have been around a long time, older styles were hard-wired, with installation being a tedious mechanical process. Now, it’s a digital process, and it’s wireless. Retailers must get consumers to understand that, regardless of the complexities of the internet of smart home devices, everything is integrated to work together seamlessly and is easy to install, easy to set up, and easy to use.

In reality, even today, installation of a wireless alarm system only takes a couple of hours at most. Actual installation can be simple. The bigger challenge is to have the consumer understand what’s possible for them to get. Find out more about beating the challenges in selling smart home solutions by viewing our webinar on demand.

Challenges of market fragmentation

In the big box home improvement retail space today, for instance, displays are not concentrated as systems on the sales floor but instead tend to be disconnected (locks in one area, light bulbs in another, sound in another area, and smart appliances in another). That makes it hard for consumers to grasp the totality of what’s actually possible within their home.

Shopping independently, the consumer can only see

- Competing brands

- Competing products

- Competing operating systems

In order to bring a whole-system sale to life with all the ancillary products that go into it, the Retailer must plan, order, and merchandise to correct these inconsistencies and create a perfect sales circumstance.

One consistent aspect of all systems, at least for now, is the need for a hub, some type of Wi-Fi interface controller or pass-through device. It could be in the form of a router, or just be the device itself. Since everything is wireless, the hub allows the devices to interact with each other so that it appears seamless. But there’s actually a line of translation to it.

Consumers buying a smart home device, each of which has its own app or operating system, will need some type of hub in order to integrate it within their home. But with inconsistent or separate pieces of a system, there’s always the possibility that there will be different languages in use, which would interfere with seamless integration.

Some devices do have routers, which create their own wireless mesh network, but those are unique to their brand. For example, a successful sound speaker might do a great job within it’s own system, but is only compatible with its device. If the consumer wanted to build out a full sound system with it, they’d have to use only that brand, or send the content through a third-party hub.

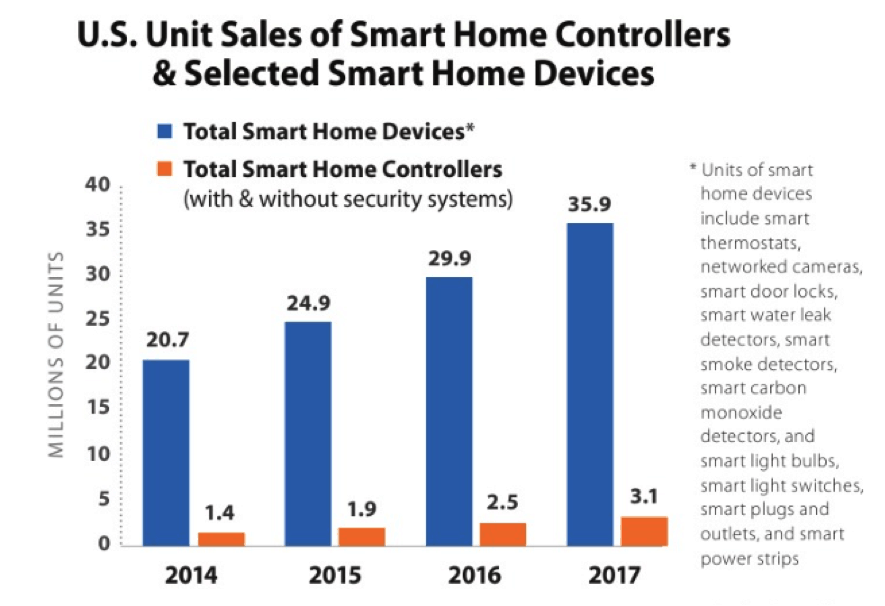

As seen in the chart below, hubs still have a long way to go to become widely integrated in homeowner systems.

*Reprinted with permission of www.CE.org

The technology for smart homes and connected homes accelerates so quickly, there’s a conception that the devices can be outdated pretty quickly, within a year or two years. After all, in the history of electronics, changes, like when TV went from black and white to color, used to happen over a long period of time.

But with an operating system like the hub, which is often wirelessly update-able, advances could require only minimum technology changes. That’s a big reason why this product category has accelerated so rapidly.

Slow consumer adoption

For categories like consumer technology, early adopters are the “pioneers,” the ones who come in and take hold of a new item and run with it. They are the ones who want to be the first and the fastest to use the coolest technology.

In order for an early adopter product to cross the chasm into mainstream, it’s got to have market penetration. Once it hits the mainstream, it can really take off. Nest is a perfect example. Who would have thought that consumers would be interested in a three hundred and fifty dollar thermostat?

Well, it turned out to be pretty cool, and it saved them money. It “learned” them; when they were away, when they were in the house, what temperatures they preferred. And in a short time, that product has gone mainstream.

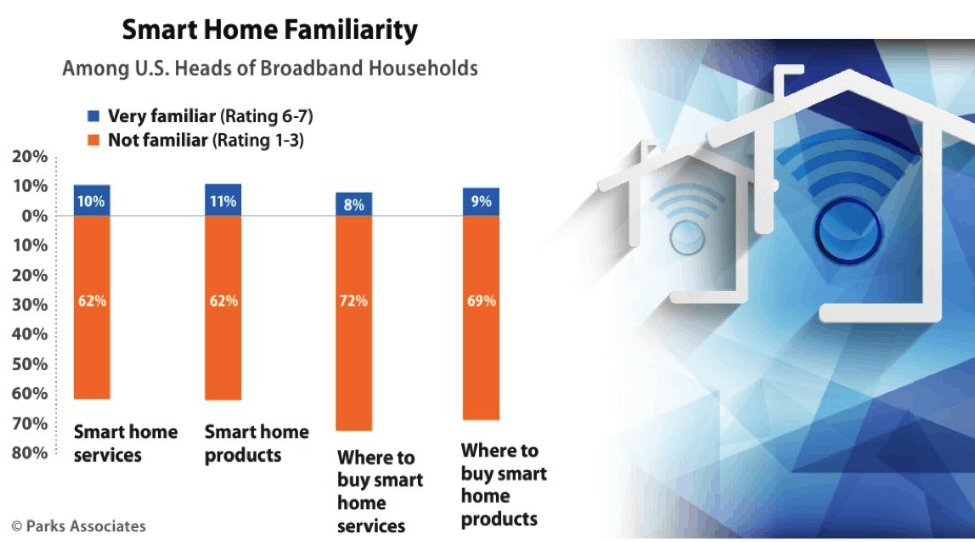

According to the CTA study, however, most households in the U.S. are not even familiar with either the possibilities of smart home solutions or where to buy them.

*Reprinted with permission of www.CE.org

*Reprinted with permission of www.CE.org

Some of the circumstances causing adoption slow-down are:

- The only way for a consumer to get a full solution set-up currently is through an alarm or cable company that will come to the home and install it. That’s expensive, and it comes with a subscription fee.

- Most Millennial customers are not interested in subscriptions—they would rather do it themselves, and not pay a subscription fee. They’re digital natives and willing to spend two to three thousand dollars on a system, but they want intuitive set-up, and want to be able to do set-up themselves.

- Millennials might buy one piece at a time, but then there’s a danger that if the app languages are incompatible, they won’t be able to operate the pieces together—at least not seamlessly.

- Retail category managers often order smart devices separately, by category, rather than as systems in one strategic plan, which can inadvertently encourage consumers to pick out disconnected pieces.

- The older generation of Baby Boomers, on the other hand, most often just wants convenience. They understand the technology of the smart home solutions, but they don’t want to be bothered by it. And they want low out-of-pocket expense, around $500. They’re willing to pay the subscription service, and installation costs, but not willing to invest heavily in a system on their own.

The whole crux of the industry challenge in getting adoption is that solutions are different for each of the different customer groups.

- For the alarm and cable companies, the target customer is the Baby Boomer with a mindset focused on convenience and price.

- The rest of the world is looking for Millennials and Gen-Xers (a bigger market than the Boomer generation) who prefer do-it-yourself ease and pricing.

Need for in-the-aisle education

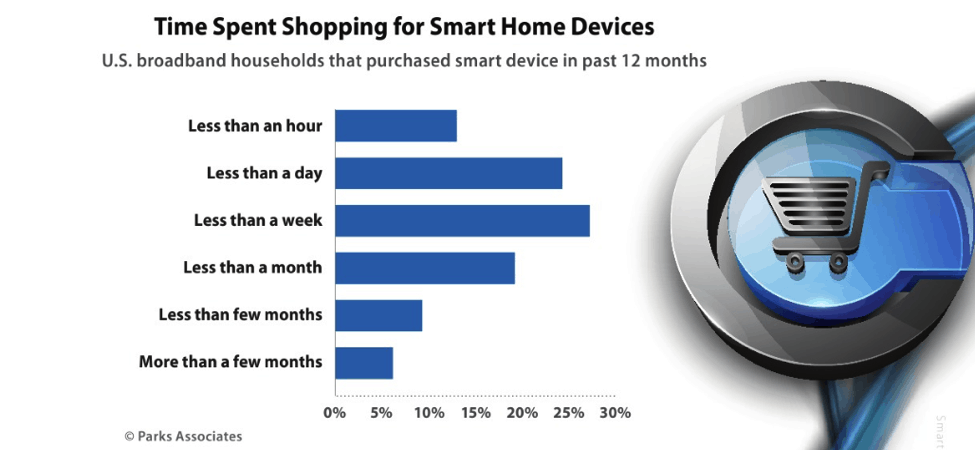

Between convenience and ease, as seen in the graph below, most shoppers are spending less than a week on their own determining what their best smart home solutions are.

*Reprinted with permission of www.CE.org

*Reprinted with permission of www.CE.org

Given the complexity of the integrated devices concept, retailers need to offer a higher degree than average of in-aisle education for their customers. But due to cost of labor challenges, there’s often not anybody to help the consumer in the aisles where the products live.

All the great interactive displays, that you’d think would help bring the products to life, often are simply not set up in a way that shows the real home environment. Displays usually just explain a product. When you need to connect that product to the whole solution, there’s a gap. Are we overlooking the human touch?

Someone needs to be there, and be able to help bring the consumer to the realization of what is possible.

Granted, right now the margin is very thin in most categories in retail. And so, to manage, retailers are either cutting OpEx or looking to the manufacturer to provide labor in the stores.

That can work well when handling sales of a stand-alone product—a TV, a set of speakers, etc. But when you put the buyer’s environment into the system, it’s a whole different issue. Environment changes the dynamic of what you’re trying to sell.

Margins on smart home products, unlike the norm, are likely going to be better than those on products elsewhere in the store. Gaining the velocity of this emerging category at higher margin can allow the retailers to invest in extra help.

If a Millennial or Gen X’er says, “I’ll spend two to three thousand dollars on a system,” that’s great. But when there’s nobody there to help them—it doesn’t work. They will turn to online, and do their own research.

Consideration for customer lifestyle

In the retail space, you have to show consumers what will work for them—the actual hub and the devices that go with the hub which will solve their wants and needs.

Electronics for a long time was a commodity product. But it’s slowly evolving to be personally adaptable. Personal attention is needed more than ever to sell consumer technology products:

- It’s individualistic. What you want in your system and what I want in my system will be different. It’s a personal, lifestyle choice.

- There must be a concierge, or someone knowledgeable, to help design what the consumer wants. When personal choices are there, and available, there’s often nobody there who can explain it.

- The prices often don’t make sense initially, unless there’s some explanation, some way to understand the value.

And you have to teach the consumer how a system can be used to benefit them.

For example: A working mom can engage a system from her smartphone when her kids approach home after school. It contacts the hub which turns on the lights, preheats the oven for pizza, adjusts the home temp and unlocks the door as they approach. And when the kids walk up to the house, it’s open and ready. The Mom is then notified that they’re safely inside, so she can reset the locks.

The customer needs to be sold what’s a best fit, for their needs and their lifestyle.

Of course, without getting a full system and a hub, they would also need to know they would have to access separate apps to do all that.

What kind of sales training is needed?

- For the Retailer, a reliably trained sales team can efficiently provide expertise to consumers within the aisle, presenting an agnostic solution, one that’s not brand specific.

- For Brands, deployed, trained sales associates can share specific messaging about their systems. Whether they’re a very new and “cool” brand, but relatively unknown, or are well known but without that cutting-edge image, they can use trained field sales associates to help consumers understand, design and build their systems. Or they can train retail sales associates on how to sell a whole system.

In short, there has to be someone there presenting the value in such a way that it doesn’t appear to be a “hard sell” speech. This is what a retail solution provider will do. If representing the retailer rather than the OEM, they would present a whole solution, regardless of brand crossover. And what the retailer needs to do is present a whole solution.

CONCLUSION

Every major retailer is going into the smart home solutions space, trying to figure it out. Some that are in the forefront right now are finding it difficult to bring to life. They are struggling to grasp how to be able to present a whole home solution to a customer. Others are taking a step back and trying to make it an environment, which is a smart idea. MarketSource, Inc. has a retail solution for bringing the smart home “Holy Grail” of sales situations to life. It may be just the solution you need!