Are Auto Mechanics in Demand?

In 2021, we discussed the critical shortage of automotive technicians at dealerships, as well as independent repair facilities and large fleets who complete their own maintenance and repairs. Today, two years later, there’s both good news and bad.

The 2022 TechForce Foundation Technician Supply and Demand report found that the number of employed auto technicians is trending up. Their most recent count of employed automotive technicians was 733,200, a 4% increase over the low point in 2020. That said, that count is still almost 613,000 below the number of technicians that TechForce believes are needed by the end of 2024.

Source: TechForce Foundation

At franchised new vehicle dealerships, the National Automobile Dealers Association (NADA) estimated that currently, there are approximately 56,000 unfilled technician positions. As of June 2023, reported there were 258,004 active technicians at franchised dealerships. This represents an increase of 3% over June 2021, when NADA recorded 249,653 technicians employed at dealerships, but that number represents only 14% of the estimated technicians needed by the end of 2024!

Auto Tech Shortage Drives Revenue Loss and Hurts Service Capacity

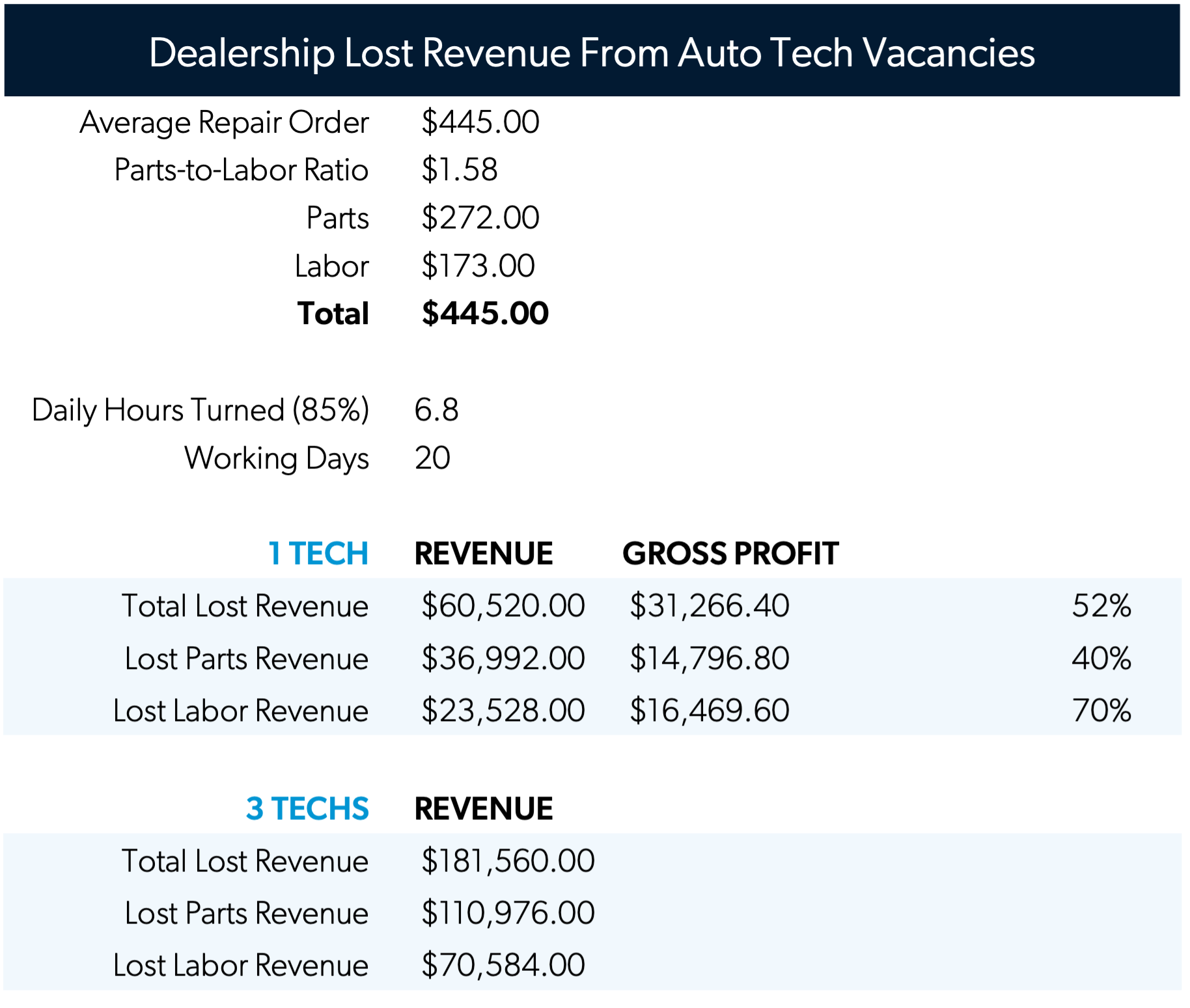

Our research indicates that many new vehicle dealerships have three technician openings at any time. The 2023 NADA mid-year report indicated that the average customer-pay repair order (CPRO – for parts and labor) was $445. If we assume an 85% productivity rate and 20 working days in a month, each technician job opening results in lost parts and service revenue of more than $60,000 per month, meaning three openings represent more than $180,000 in lost revenue monthly!

Most dealerships I’ve visited and spoken with have plenty of work but not enough capacity, indicating that if they could find or develop quality techs, they could certainly keep them very busy! Our teams consistently see situations where dealerships cannot accommodate basic services, such as oil changes and tire rotations, without an appointment three or four days in advance. At least two of the OEM’s we work with to schedule repair appointments for some of our recall canvassing programs report that upwards of 30% of their dealers are unable to accommodate repairs for at least four weeks out. This results in not only lost revenue outlined above, but also in customer dissatisfaction with the service department that is likely to result in future lost sales.

One very large dealership we work with recently told me they do not have the capacity in their shop to utilize their BDC for outbound service appointments because they don’t have enough qualified techs available to perform needed services.

We spoke with a very large government fleet that is struggling to find dealers willing to complete any requests for pricing, making it extremely difficult to keep their vehicles on the road.

In some of these cases, parts availability and service bay constraints have been contributing to longer repair completion times, but in most situations, technician shortages are the largest contributor to service delays and frustrated customers.

Why the US Has a Shortage of Auto Mechanics

As we discussed a few years ago, there are multiple reasons for a continuing technician shortage as identified by the TechForce Foundation and NADA.

- The aging (mostly baby-boomer) technician workforce is retiring in larger numbers each year, estimated as high as 9% annually

- There is a lack of women technicians. Data indicates that women represent less than 1.5% of the technician population

- There is a relatively high turnover of B-Techs in younger generations

- Fewer technicians are graduating from the ten largest providers of post-secondary automotive degrees. For example, in 2012, these schools had total degree completions of 40,658; however, by 2021 that total had decreased by 34% to 28,866, woefully less than the number needed.

To gain an understanding as to why we continue to see a lack of interest in automotive repair careers, IMR, Inc. conducted an exhaustive survey of current auto technicians. See below for some findings.

- Technicians generally believe franchised dealers have nicer facilities, over general repair and fleet and commercial facilities

- Technicians don’t like OEM warranty work, with 80% reporting they think warranty reimbursement rates are unfair

- More than 84% think high schools discourage students from entering the trades

- Almost 100% prefer unscripted, unproduced videos of employees talking about what it is like to work in their shop over corporate videos

- A third of the techs interviewed think the biggest challenge for a new technician is the initial tool investment (it takes at least $3,000 to get started)

- More than three quarters of the individuals surveyed don’t think their place of work does enough to help schools attract more students into their technician programs

- Three quarters of technicians indicated that they would refer someone to work at their shop

- Almost 60% said they would be willing to share a job post on social media

My guess is that if you’ve been involved in dealership fixed operations management for any period of time, this information won’t surprise you. The good news is that most—if not all—of these realities can be remedied and turned into positives, helping you grow your fixed operations revenue and gross profit, along with customer retention and satisfaction.

Looking to the Future—What Can the Auto Industry do About it?

A remedy is going to require collaboration and commitment from a wide range of industry stakeholders. One thing we know is that while electric vehicle registrations are growing exponentially—annual sales are expected to exceed 1,000,000 units for the first time this year—they still represent a very small percentage of the 292 million-plus vehicles registered in the United States.

A recent report in CNN Business by Christopher Hickey noted that the US Energy Information Administration predicts that “…assuming current laws and regulation don’t change, the annual percentage of newly purchased BEV’s and PHEV’S flattens at roughly 17-19% from 2035 to at least 2050. The EIA also predict that, given consumer interest in EV’s is sensitive to the price of gasoline, an EV market share of less than 30%, even with oil prices as high as $190/barrel in 2022 dollars.”

Solving this problem will require an industry-wide effort to:

- Reduce the turnover of existing technicians by ensuring techs have defined career paths for their personal goals, with timelines and metrics (this requires a commitment from tech and dealership management)

- Develop and maintain a robust pipeline of technicians through:

- Expanded dealership management relationships with local technical school/high school/colleges with automotive programs

- Deeper dealership financial commitment in the form of donations, career days, and technician shadowing

- Dealership involvement in OEM programs offering apprenticeships, ongoing education, and certification

For a deeper dive into the broader impact of EVs on dealerships, read our white paper, 6 Ways to Take Charge of Your EV Future.

Build Your Auto Technician Pipeline

We currently work with OEMs and dealers to help dealers meet and sustain their various technician needs. We focus on addressing the items listed above as well as other barriers that may be hindering the ability to attract and retain technicians such as:

|

|

|

|

|

|

We also firmly believe that conducting and reviewing “market studies” of a dealer’s metro area focused on how they stack up compared to your competitors is critical to gaining and maintaining an advantage in attracting and retaining quality technicians.

20.17% vs. 4%

MarketSource has helped OEM partners realize a 20.17% increase in auto techs vs. the 4% industry average.

Of course, there are so many things to be done, and there is so little time for you and your management team to assess your current state, let alone develop a plan, and then implement and maintain it. Over the last few years, it seems as though every business is short-handed in many roles, and staff have been asked to increase their bandwidth. Dealership management has its hands full dealing with the day-to-day business, not permitting any time to focus on the future. We can help with that!

We are having great success helping dealerships with technician retention and recruiting. Since Q4 2021, compared to an overall repair industry gain of just 4%, we’ve helped our dealer and OEM partners realize a 20.17% increase in auto techs employed at their dealerships!

OEMs hire us to design strategies to reduce annual technician turnover, increase the number of technicians, and ensure a strong and reliable pipeline of new technicians. We’re able to do this thanks to:

- Our automotive practice team’s wealth of retail automotive experience in all areas of dealership operations, including fixed and variable operations, which gives us the ability to earn dealership personnel respect (we’ve been in their position)

- Proven results implementing long-term process changes at dealerships and gaining dealer principal commitment to precipitate true, long-term, dealership-wide, impactful change

- Our ability to serve as a “conduit” between dealers and the OEM. We understand what is at stake and in it for both parties and can drive home the “What’s in it for me?” opportunity to dealership personnel, bridging what can be a contentious relationship between the dealer and the factory

- The internal expertise of our Business Process Engineers (BPEs) and Instructional Designers (IDs), who work in concert with our sales tech stack and a customized instance of Salesforce to ensure the dealerships and OEMs we work with are achieving their goals

- Our ability to pivot quickly and adapt to changing market conditions as needed (we call this Relentless Incrementalism, and it fuels all our client programs)

Benefits of Outsourcing Auto Tech Recruiting

To OEMs:

- Higher customer satisfaction timely service appointments are available to OEM customers in need of maintenance, repair and/or warranty work, and because cars are “fixed right the first time” with the best parts, completed by highly trained OEM technicians.

- Increased brand awareness and loyalty

- Increased sales of OEM’s parts used in dealership repairs

To Dealerships:

- Higher customer satisfaction because customers receive quality service quickly

- Increased gross profits from parts and labor revenue

- Higher service absorption

- Increased customer retention

- Stronger overall dealership profitability

Ready to talk?

We’ve strengthened fixed op departments and boosted profits for major OEMs and dealerships across the country, just as we can for you.

Author: Lisa Walsh

Lisa is Executive Director of Automotive Solutions at MarketSource. She brings 35+ years of automotive experience to her role. Lisa has owned her own dealership, served as a dealership finance director and general manager, and was a business development manager at GM. In spearheading results for dealership fixed and variable operations as well as OEM accessory and fleet sales, her clients consistently achieve greater account growth, market share, customer retention, customer satisfaction, and more.

Want More Sales?

Subscribe now to receive occasional emails with insights that help you accelerate profitable growth, risk reduction, market expansion, and revenue velocity.

What are you waiting for?