Digital retailing is taking the auto industry by storm. Accelerated by COVID and traditional sales model disruptors such as the Carvanas and Teslas of the world, a fundamental paradigm shift is occurring, and chances are, customers aren’t going back. In an industry that historically has relied heavily on face-to-face customer interactions, for dealers willing to make digital a core element of their customer engagement strategy, growth opportunities abound.

Digital retailing is the process that allows customers to complete their car purchase entirely online. From researching vehicles and pricing, to exploring financing options and completing credit applications, to scheduling test drives and delivery, for dealers that offer them, every step of the traditional buying process has moved online.

When it comes to the new digital paradigm, manufacturer and dealer responses vary widely. Some think slightly beyond the showroom to offer digital promotions and call it good. Others, such as Nissan, enable entire transactions—from first inquiry to fulfillment—solely online. Regardless of where dealers fall on the spectrum, there is no doubt digital secures their growth opportunities.

Digital retailing gives dealers a mechanism to deliver value and foster loyalty without sacrificing profitability, accuracy, or efficiency. While there’s little uniformity across digital dealer offerings and the ways customers engage them, what is consistent is the significant upside digital retailing offers dealers who incorporate it into their customer engagement strategy.

Transitioning to digital isn’t an all-or-nothing proposition. At least for now, most buyers—75%—still want to visit a dealership for some part of their purchase. The key to dealer growth today is learning which parts of their purchasing process customers prefer to complete online, anticipating when they plan to move in-store, and meeting them where they are by tailoring each step of their journey.

Customers are Steering the Sale

Customers have become accustomed to the convenience and control online shopping affords them. When it comes to auto shopping, they like being in control of how they move through the buying steps.

While no two customer journeys are the same, the Cox 2021 Car Buyer Journey Study found that because consumers are completing more car-buying steps online, the average buyer visits only two dealerships.

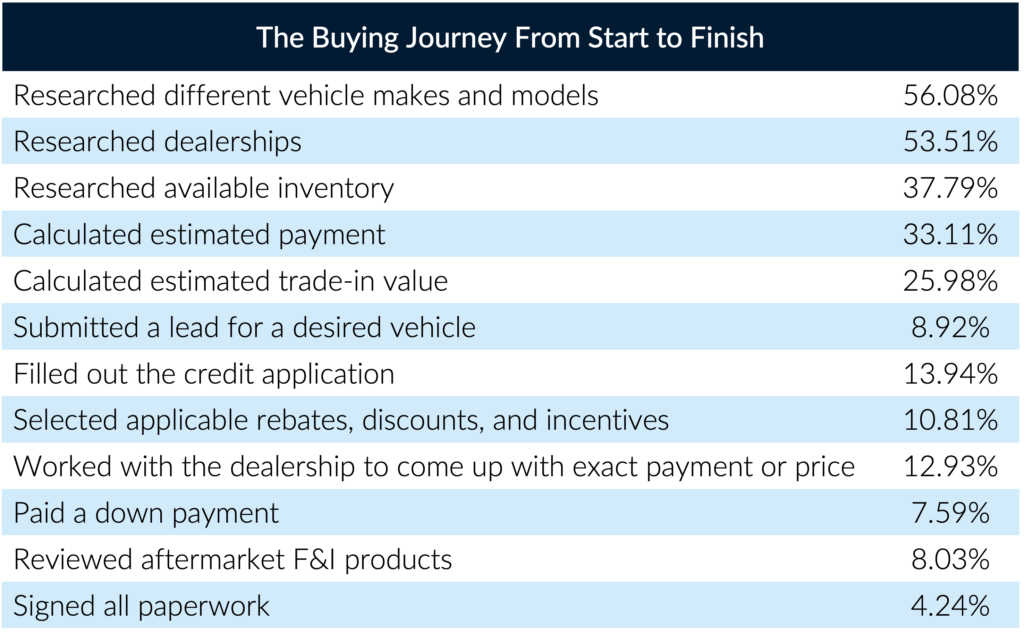

What are they doing online? According to Reynolds & Reynolds’ most recent Car Buying Unfolded Report, respondents’ buying journey mapped out this way:

What portions of your vehicle purchase did you complete online or without going to the dealership?

Source: Reynolds & Reynolds

Some dealers perceive that digital retailing requires them to relinquish control, but data shows the opposite. It sounds counter-intuitive, but by empowering customers to buy the way they want, dealers who embrace digital retailing are actually gaining control over their customers’ experience. Not only does digital enable a more efficient sales process; but it also reduces personnel costs, which, according to the National Automobile Dealers Association (NADA), cost dealers an average of $4.09 million in 2019.

Digital Retailing Moves the Needle

And the benefits of digital don’t end with staffing savings. In a joint study NADA conducted with Roadster, of the dealers surveyed, 61% said that digital retailing improved their sales efficiency. Dealerships surveyed with digital retailing solutions sold an average of 18+ cars per salesperson, per month in 2020—a 38% increase in average number of cars sold per person, per month over 2019. The less time that it takes a salesperson to complete a sale, the more transactions they can complete. More cars sold means higher Dealership variable gross profit revenue.

Aside from increased operational efficiencies and profits, digital reduces the amount of time the customer spends in the dealership taking delivery of their vehicle, one of the most vehement customer complaints about the car buying process.

The Cox study found that, compared to buyers who completed fewer steps online, mostly-digital buyers (those who completed at least 50% of their purchase online) were more satisfied with the price they paid and had more trust that the dealership or retailer gave them the best deal. Additionally, completing digital steps created a more satisfying experience overall. Digital buyers who completed most of their purchase online were more content with the overall purchase experience and the time spent in transacting, possibly attributable to better vehicle selections and less sticker shock.

The F&I Factor

A less obvious area of opportunity for digital is F&I. In fact, Reynolds & Reynolds found that 40% of car buyers they surveyed felt it was extremely important to have a person available to talk to about finance and insurance products when shopping online. Dealers can connect their F&I staff to prospective customers in multiple ways, from live chat to video calls.

In addition, the majority of customers Reynolds & Reynolds surveyed reported being willing to pay more for their vehicle if they could complete certain F&I tasks online. The study found 59 percent of customers saw themselves as extremely likely to spend more if they could review and select F&I products online, and 61 percent gave the same response regarding working with a dealership online to determine the exact vehicle payment or price. Nearly half — 49 percent — felt they were extremely likely to spend more just by being able to fill out an online credit application.

Breaking Down Omnichannel Barriers

From enabling frictionless upfront customer research to offering virtual engagement with F&I experts, a digital strategy involves leveraging the confluence of in-store and online experiences to greet customers where they want dealers to meet them. Dealers that give customers seamless experiences across every channel, whether online, in person, or via phone, will deliver on customer expectations for a consistent, end-to-end, personalized experience.

Before turning to processes or technology, dealers should create a mission statement for their digital strategy to help them keep it top of mind for their entire staff.

Once they’ve made the commitment to incorporate digital, or expand their strategy if they already have one, they would be wise to make sure their website is intuitive, mobile-friendly, and conveys accurate inventory and pricing information. Provide real-time customer engagement channels, either through live chat, chat bots, video chat bots, or virtual brand representatives.

For other steps in the process, it’s essential to offer functionality that makes it as easy as possible for customers to handle the parts of the process they most want to do online, including:

- Determine a final price

- Get finance quotes

- Calculate their monthly payment (through calculator widgets)

- Pinpoint their trade-in valuation

- Complete and submit a finance application

- Make a deposit

- Schedule test drives, home delivery, and service appointments

- Connect real-time with an F&I expert post-sale

- Browse vehicles virtually and take showroom tours

Soon, just as power windows and Bluetooth are the standard in new cars, customers will come to expect this self-service functionality as customary and will skip dealers who don’t offer it.

Building New Digital Roads

All signs point to the customer experience being at the crux of the sale, no matter how or where it takes place. The most successful dealers will allow customers to buy the way they want across all departments. And they’re prepared for an online customer to move in-store at any moment—seamlessly.

It’s difficult to think about making improvements to your customer engagement strategy when profits are so high and customers are easy to come by. But dealers who address their digital retailing shortfalls now are going to be light years ahead of the competition when inventory and profit levels normalize.

It may mean tailoring the buying experience to each customer and creating value for them every step of the way, and it may require some fundamental, possibly uncomfortable, shifts in your thinking and your operations. But a robust digital customer engagement strategy will reap significant rewards and enable you to deliver your customers a consistent, seamless experience across all channels. If you execute it well, they’ll be back, no matter whether their journey occurs online, in-store, or a blend of both.

Ready to talk?

Want to enhance your customers’ experience while accelerating your sales? MarketSource can help.