WOW! How unexpected and crazy the last two years have been for automobile dealerships across the country! Almost every dealer has enjoyed record profits, thanks mostly to unprecedented gross profits on new and used vehicles. They also experienced reduced expenses from lower advertising and floor plan costs (which were profit centers in 2021). Who could have imagined that, in the throes of a pandemic, dealers across all makes and models would realize total new vehicle sales gross profits in excess of $5,000 per vehicle retailed, and that the average dealer would earn more than $200,000 annually on floor plan credits?

What a boost to the industry and a welcome relief to dealers who wondered how they, along with businesses around the world, would survive the economic shutdown, let alone a chip crisis. Who could have predicted that they would not only survive but thrive, achieving record profits?

It’s tempting to want to revel in this moment and to bank on today’s profit levels lasting far into the future. But dealers who resist the temptation to get caught up in the irrational exuberance of this moment and take this opportunity to shore up their sales operations are positioning themselves not only to weather the next market shift but to maximize future revenue growth.

Irrational Exuberance

In addition to unprecedented profits, most dealerships also enjoyed lower costs for non-commissioned personnel in both their new and used vehicle departments. They realized these gains, even as individual resource wage costs increased. In most cases, the decrease was a result of reduced operating hours and fewer human resources needed to conduct pre-delivery vehicle inspections, lot-ready detailing, and reconditioning.

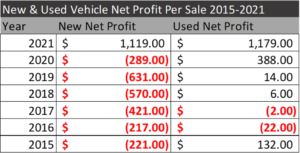

The snapshot below from the National Automotive Dealer Association (NADA) illustrates the dramatic shift in new and used vehicle net profits from 2015 to 2021.

Source: : National Automotive Dealer Association

As you can see, in every one of the six years prior to 2021, dealers averaged a net loss on every new vehicle sold! Keep in mind that this number doesn’t include “other income” or factory incentives. Enter chip shortages and COVID-driven supply chain issues, and suddenly, dealer net profits in 2021 averaged more than $1,100. Used vehicle sales saw similar increases, with net profits growing from a six-year average of $86 per vehicle in 2015-2020 to almost $1,200 in 2021.

Interestingly, on the fixed operations side, total sales and gross profits grew about 10% over 2020 but only about 1% compared to 2019. Most dealers I’ve spoken with indicate that most of this increase came from increasing parts prices. Remember—fixed operations is not the back end of your dealership—it’s the backbone!

At the same time, most stores are having issues filling both experienced and entry-level technician openings (I talk about the technician shortage in this blog post). Combine this with parts shortages, and customers are finding that vehicle repair delays have become the norm.

Most experts believe that the new vehicle shortage will persist well into 2023. While inventories may start improving, high inflation, along with rising interest rates, appears to be dampening consumers ability and desire to purchase a new vehicle. Data indicates that the days’ supply of new vehicles, while still low, is growing. Most experts believe this is due to reduced customer demand versus supply constraints. This will encourage many customers to keep their vehicles longer, which could mean more service opportunities for your dealership. But, if you’re short on technicians, you risk losing current and future opportunities in both fixed and variable operations.

Despite these complications, there has been a fundamental paradigm shift, at least temporarily, in our entire business and in the competitive atmosphere with neighboring dealers. Two years ago, it was impossible to envision a world in which inventory was so low that customers would be so thrilled to find and buy a car (maybe not even their first choice) that price as a deciding factor became irrelevant!

Headwinds in the Forecast

Having spent 40+ years in the retail automotive business (with 14 of those as a Dealer Principal), I have never seen an environment like this. The closest experience I can recall relates to a specific franchise and only lasted for a finite time. It was the late 1970’s, when American Honda was focused on increasing their U.S. footprint. Most of the Honda facilities at that time looked like glorified service stations, and there was very little, if any, available inventory. In fact, dealers actually sold from their incoming inventory. If a customer wanted a vehicle, they had to put down a deposit to reserve it and wait for the vehicle to come in. Many folks would put deposits down with all the dealerships in their local area, purchase from the one that received the vehicle first, then seek refunds from all the other dealers. The customer and dealer excitement and buzz around taking delivery was incredible.

How Dealerships Can Prepare for What Comes Next

This scenario certainly seems eerily like today’s environment, although now, dealers of all makes and models are now enjoying the momentum! While it certainly doesn’t seem like vehicle inventories will ever rise to pre-pandemic levels again, it may become more difficult to realize the incredible revenue streams that new and used vehicle sales have been producing. So, the question of the day is, “How can I prolong this unparalleled prosperity?”

How do you position your dealership to weather what comes next? As you think about how you’re going to elongate today’s success into tomorrow’s growth, consider these questions:

- Have these historic profits been a result of the improvement of your sales processes and customers’ experience?

- Do you expect this profit level to continue for the foreseeable future? Specifically, beyond 2023?

- Have your salespeople, managers, or BDC personnel become complacent?

- Have you maintained the training and development of your variable operations team, or have you cut back your investment?

- Regarding your fixed operations, have you begun to develop a technician pipeline focused on resolving both your short- and long-term needs?

- Are you building relationships with local high and secondary schools to expand your pipeline of future candidates?

- Are you addressing overall dealership employee retention rates? Are you establishing career paths to foster professional growth and loyalty?

- Are you evaluating the “build-to-order” model? If you’re considering adopting it, are you prepared? What will the impact be on your revenue?

If you answered “no” to any of these questions, it’s probably worth examining how your store processes are holding up. It’s tempting to get lax in certain areas and assume that profits will remain high, even though rationally, we know that’s unlikely. And it’s easy to get “out of shape” when demand is so strong that customers land in our laps with little effort!

I know it’s especially easy to let variable ops team training slide because it can feel like it doesn’t make a difference. Try to resist that temptation. You need a staff that has the skills to operationalize this momentum and dominate whatever wave comes next. Of course, none of us can forecast the future, but it’s unlikely profits will remain robust indefinitely. It’s wise to acknowledge that there may be some headwinds on the horizon, such as:

- Increasing new and used vehicle prices, reducing affordability

- Increasing customer monthly payments and loan terms (73% + of new vehicles finance terms were more than 60 months, with 34% of those exceeding 72 months)

- Increasing inflation will continue to drive interest rates higher. This will continue to impact customer affordability and increase dealer operating expenses

- Purchasing transformation from in-person sales to a completely digital experience

- Sales managers, F&I managers, and salespeople will underperform because, due to lack of inventory and high customer demand, they’ve grown complacent with the sales process (having been able to rely on luck rather than skill for months)

- Reduced service business due to a lack of technicians

- Reduced service loyalty

- Reduced dealership profits and customer retention

- Increasing difficulty retaining employees

Low Inventory = The Perfect Time to Take Stock (of Your Sales Ops, That Is)

There is no better time to prepare for the future while momentum is high! To maintain your profits, consider reviewing your existing operations.

Some key areas of focus might be:

Sales Process: Assess your process and customer satisfaction scores. Are salespeople following your desired process on a consistent basis?

Customer Experience: How is your digital buying process from a consumers’ perspective? Identify and prioritize areas that need improvement

Staff Training: Ensure you’re providing your team the training and development they need for long-term success and customer satisfaction. Hold them accountable for their own development

Fixed Operations: Assess your current and future technician needs and make plans to expand your pipeline to meet those needs

Customer Loyalty: Implement pick-up and delivery and mobile van options for service customers

Sales Pipeline: Ensure your BDC is actively reaching out to and converting both sales and service customers

Employee Retention: Develop, implement, and update employee career paths and compensation plans focused on ensuring productivity and retention

Now is the time to review these areas so that you and your dealership are ready for the future, whether there is a return to historic norms or a completely new way of doing business emerges. Even if the buying process returns to the traditional model, seeds have been planted that may lead to permanent change and new opportunities.

Ready to talk?