Five New Year’s Resolutions for Auto Dealers Returning to a (New) Normal

The auto industry is emerging from another highly tumultuous and prosperous year, marked by record profits, significant inventory issues that challenged manufacturers to keep pace with consumer demand, continued evolution of customers’ buying behaviors, persistent supply chain issues and chip shortages, economic headwinds of rising inflation and interest rates, and pressure to go all-in on electric vehicles.

These realities have demanded a level of dealer agility that, as the market begins to normalize and competition returns, they’ll have to embrace.

“Dealers, who have long dealt with declining profit margins, deserve to celebrate the prosperity of the last three years,” says Lisa Walsh, executive director of automotive solutions for MarketSource. “It seems the party is over, however, and we’re in the process of returning to a new normal. The questions are how fast, what ‘normal’ will look like, and where dealers should focus as the market transitions.”

To help them prepare for that new normal, Walsh and Peter Maxwell, vice president of commercial, automotive client services, recommend dealers make five New Year’s resolutions:

#1 – Reorient Your Strategy Around Your Customers – A customer-centric approach is no longer an option – it’s table stakes. With customers able to guide themselves through much of the buying journey, rather than forcing a one-size-fits-all approach on every customer, dealers need to be flexible enough to allow customers to dictate the buying process. They also need to be able to facilitate an end-to-end digital buying journey. Maximize your opportunities to blow their minds. If you don’t, they’ll find a dealer who will

#2 – Commit to a Rigorous Sales Training Regimen – Invest significant energy and time training and re-coaching salespeople to sell in a competitive environment. Equip (and where necessary, upskill) them to adapt to how customers are buying. Train them to center the sale around the customer experience

#3 – Be Bold about Your Value Proposition – Consider offering value-added services that can become your differentiators, and create or crystallize your dealership value proposition around what makes you distinct from your competitors. Rally and structure your entire dealership around your value proposition, and boldly convey it to every current and prospective customer

#4 – Expand Your Showroom (without Expanding Your Hours) – Work smarter—not harder—at serving your customers. By augmenting your team with virtual product discovery experts who can be available for customers when they want to shop, you can avoid expanding your showroom hours and taxing your sales team, many of whom are enjoying the greater work-life balance COVID-era profits afforded them.

#5 – Get Back to Basics – Insulate yourself against unpredictability by refocusing your team on sound sales practices and strategies that win in any market. Even though supply chain issues, economic uncertainty, and fluctuating inventory levels persist, realigning your business around effective sales processes will empower you to meet your revenue goals.

Resolution #1: Reorient Your Strategy Around Your Customers

Gone are the days when dealers and sales staff controlled all aspects of the sale. All signs point to the customer experience being at the crux of the sale, no matter how or where it takes place. Today’s customers have become accustomed to the convenience online shopping affords them, and they like being in control of how they move through the buying steps.

And they’re prepared for an online customer to move in-store at any moment – seamlessly. To capture these customers, well-prepared dealers should tailor the buying experience for each customer and create value for them every step of the way. This may require some fundamental, possibly uncomfortable, shifts in your thinking and your operations, but a robust digital customer engagement strategy will reap significant rewards. If you execute it well, they’ll be back, no matter whether their journey occurs online, in-store, or a blend of both.

Here are some solutions dealers can put into place today to reorient and centralize their operations around customers’ needs:

- Make it easy for customers to buy—across all departments. Most buyers—75%—still want to visit a dealership for some part of their purchase. The key is learning which parts of their purchasing process customers prefer to complete online, anticipating when they plan to move in-store, and meeting them where they are by tailoring each step of their journey.

- Provide your customers with a consistent, seamless experience across all channels. Our blog, Rethinking Customer Engagement for Auto Dealerships, explores this in detail.

- Deliver customer value that transcends vehicle and service prices, such as mobile vehicle service offerings, or pick-up and delivery for routine maintenance visits. According to the latest Cox Automotive Study, only 21% of dealers in the U.S. are offering mobile service, leaving plenty of room for those looking to up their customer experience game.

- Consistently—not just periodically—offer excellent service in all areas, from sales to delivery to service. According to Forbes, in 2023, customers will be more demanding than ever, and their expectations of the basics of a good customer experience will continue to rise. Consider training and incentivizing your teams to exceed customer expectations.

- See beyond the transactional nature of your customer relationships. Focus on the long-term possibilities, and recognize their inherent value to your community, your brand, and your growth.

- Convey the value your dealership offers customers and the difference you can make in their lives (see Resolution #3 for more on this).

- Offer complete transparency about pricing. Nothing earns customers’ trust more than being transparent about who you are, how you do business, and what a transaction with you will involve.

Regardless of which of these approaches you try, keep your customers’ needs, desires, and preferences at the heart of your sales strategy. Says Maxwell, “Dealers need to abandon the thinking that customers need to fit into their process. Successful dealers will fit their processes into their customers’ buying preferences, from the discovery process, to the transaction, to the product itself.”

Maxwell reflects, “Good competition is healthy. It pushes us all to work harder for our customers. If we rally around these things and reorient ourselves to the customer experience as a dealer body, we’ll provide intangible customer value that creates loyalty.”

Maxwell added, “No matter the buying or selling conditions, making it easy for a customer to buy will never go out of style.”

“No matter the buying or selling conditions, making it easy for a customer to buy will never go out of style.”

– Peter Maxwell, MarketSource VP of Commercial, Automotive Client Services

Resolution #2: Commit to a Rigorous Sales Training Regimen

Today, according to Cox Automotive, 70% of customers prefer to shop online than physically going into a dealership. That said, Deloitte’s 2022 Global Automotive Consumer Study found that the majority (75%) of American consumers still want to buy in person. And there are parts of the buying process that they are unlikely ever to prefer completing online, such as car inspections (the 2021 Study found that 75% want to see a vehicle before they buy) and test drives (64% require these). Today’s salesperson must have the skills to sell in this environment.

As we inch toward a new normal, dealers need to focus on equipping their salespeople to sell with the customer top of mind. Dealers also need to return to the basics and arm their salespeople with the tools they need to:

- Sell to customers the way they want to buy

- Embody and communicate the dealer’s value proposition

- Develop the skills they need to support a hybrid (a blend of digital and in-person) buyer’s journey

Even if they had them pre-COVID, many salespeople are out of selling shape from the prosperity of the last few years. Simultaneously, the customer buying journey has continued to evolve, encompassing both online and in-person elements, with an increasing number of sales happening digitally. Dealers need to be prepared to consummate entire deals online. Salespeople’s skills need to align with these new hybrid journeys; they need to be both tech-savvy/embrace technology and enjoy interacting with people and be comfortable engaging all kinds of customers.

This will require intense training and, in many cases, upskilling and/or changing job descriptions for new hires. Consider tying salespeople’s pay plans to positive customer engagement results.

How dealerships sell cars has also changed significantly in recent years. Maxwell said, “During COVID, facing low inventory and high demand, it was easy for dealers to get complacent about sales processes and forget about the customer. It wasn’t a malicious response—it was pragmatic. But as we return to a more competitive market, where deals and profits aren’t throwing themselves at you, you can’t afford to be customer complacent. That stance won’t just stunt your growth; it will prevent you from competing.

“Dealers haven’t had to ‘sell’ cars for six years. Pre-pandemic, when inventory levels were high, they were focused on moving units, which didn’t require them to differentiate on anything other than price. And not having to compete for customers for the last three years has meant they’ve been able to move units without having to differentiate on anything.”

Walsh commented, “Competitive market pressures and non-brand competitors—the best dealerships train their people how to deal with these factors well. But even those who mastered this before COVID are out of shape from the recent environment. Complacency is their enemy right now.”

Because selling was easy and commission checks were high, dealers are likely to experience significant salesperson attrition in the coming months. Dealers are going to see a wave of folks who won’t hang in now that selling will take more effort for less money and longer hours.

“Today, the value versus price battle exists outside of the product and lives in the selling process. This means that now, more than ever, how we sell is significantly more important than what we sell,” says Maxwell.

This involves keeping the customer front and center and teaching selling techniques that converge with the ways customers are buying.

Resolution #3: Be Bold about Your Value Proposition

The Cox 2021 Car Buyer Journey Study found that because consumers are completing more car-buying steps online, the average buyer visits only two dealerships. To make sure yours is one of them, you must not only solidify your value proposition but embed it into the fabric of your organization and your culture.

“You must decide what you want to focus on, what matters to your customers, and what you can do better than anyone else. Your value proposition lies at the heart of where those things intersect. If you can be more of the things your customers want you to be and execute on them well, you’ll stand out.”

“The value + price combination is ultimately what leads prospects to buy, making it mission-critical for dealers to crystallize their value proposition—or define it if they’re lacking one,” says Maxwell. And it should be dealers’ North Star, he advises. What form that takes will differ for each dealer, but crystallizing their value proposition and keeping it at the forefront of their business will keep their customers loyal and their doors open, no matter what the market brings.

As we transition from inventory extremes, dealers should focus on establishing proven sales processes and delivering value to customers beyond what’s inherent to the vehicle. Maxwell advises them to build value around the dealership experience—a true differentiator—which helps customers get more value out of the product (such as fuel economy, safety options, etc.).

Customers have always needed to feel they’re winning in the negotiation process. What’s changed is their expectation of the buying process. Make sure yours differentiates you and matches your customers’ desires. Meet them where they are—guide them through their own journey. And be sure to align salespeople’s comp plans with your value proposition so they’re incentivized to embody it.

Resolution #4: Expand Your Showroom (Not Your Hours)

Work smarter—not harder—to serve your customers. Enhance their experience and expand your customers’ access to your showroom without adding to your showroom hours. Augmenting your retail-hours sales staff with virtual brand discovery experts like AskMe™ by MarketSource, with whom customers can connect when they want to shop (even after hours), in real-time, allows you to expand your sales efforts without putting pressure on your staff or your bottom line.

Staff up your business development center (BDC) with virtual AskMe reps, who are available when customers want them to be and can answer detailed product, service contract, and after-market parts questions. They can also help customers compare models, weigh financing options, and make purchasing decisions.

This approach allows you to retain a higher quality sales team, helps them retain the work-life balance COVID profits afforded them, and fosters an environment that they find hard to leave.

Resolution #5: Get Back to Basics

The unprecedented prosperity and demand of recent years have left some dealers out of shape when it comes to effective sales processes. Rather than having to focus on providing outstanding customer experiences while realizing a fair profit on sales, many dealers have been able to sell cars just by having the right vehicle and being in the right place at the right time. As the industry begins to transition away from inventory, price, and demand extremes, dealers would be well-served to return to selling best practices.

Automotive News offers these tips from dealership talent and training consultants:

- Focus on existing processes and identify any gaps or inconsistencies

- Listen to sales calls and role-play in training

- Emphasize asking good questions in conversations with customers and present options

- Offer training courses, including on-demand or virtual

- Empower sales employees to use social media platforms to engage with customers

Maxwell says, “The best sales managers aren’t the ones who manage deals but those who can embed and manage sales processes and develop people. It’s not about profit or price of the car – it’s about how much value they add to the sale with long-term, multiple car sales relationships in mind.”

Walsh added, “Market experts aren’t all aligned as to what the future will look like, but it’s certain that dealers lacking sales processes they were able to bypass during the pandemic won’t succeed. We can’t unsee the unprecedented profits of the last three years, but we can return to sound sales strategies and business practices to drive growth in this environment. Dealers who, while celebrating the excitement of record profits, heeded our recommendation to assess the current state of their critical processes, and ‘get back to the basics’ if they had strayed, will be ready to face whatever form the new normal takes.”

The (New) Normal—Are We There Yet?

Not quite. This is a return that faces headwinds, some unknown, that will keep the industry from returning to the previous normal, such as:

- What will supply look like six months from now?

- What’s going to happen in the used car market?

- What’s going to happen to the cost of money?

Today, we know supply is more robust, inventory levels are rising again, and there’s an indication that customer demand may be pent up, especially for lower-priced vehicles (although this could change if a recession occurs). We also know the days of vehicles selling for thousands over MSRP seem to be rapidly disappearing, and competition is returning, although many customers are going to remain very price sensitive. There are indications of pent-up demand, as the average age for cars on the road is 12.2 years, the highest of all time.

Market Days’ Supply, a statistic that calculates the number of days it takes dealers to deplete their new car inventory at the current rate of sale, has returned to pre-pandemic levels, thanks to manufacturers pulling out stops to deliver cars. They deployed creative tactics such as “decontenting” cars, or stripping out features so cars require fewer chips, to get them built and on dealership lots faster.

While days’ supply at the end of 2022 was 30% lower than a peak of 82 in December 2019, it increased steadily throughout 2022.

| NEW VEHICLE DAYS’ SUPPLY SNAPSHOT |

| 2H 2022 | DAYS’ SUPPLY |

| Dec-22 | 58 |

| Nov-22 | 53 |

| Oct-22 | 49 |

| Sep-22 | 43 |

| Aug-22 | 41 |

| Jul-22 | 37 |

| Year Over Year | DAYS’ SUPPLY |

| Dec-22 | 58 |

| Dec-21 | 30 |

| Dec-20 | 68 |

| Dec-19 | 82 |

Source: Cox Automotive

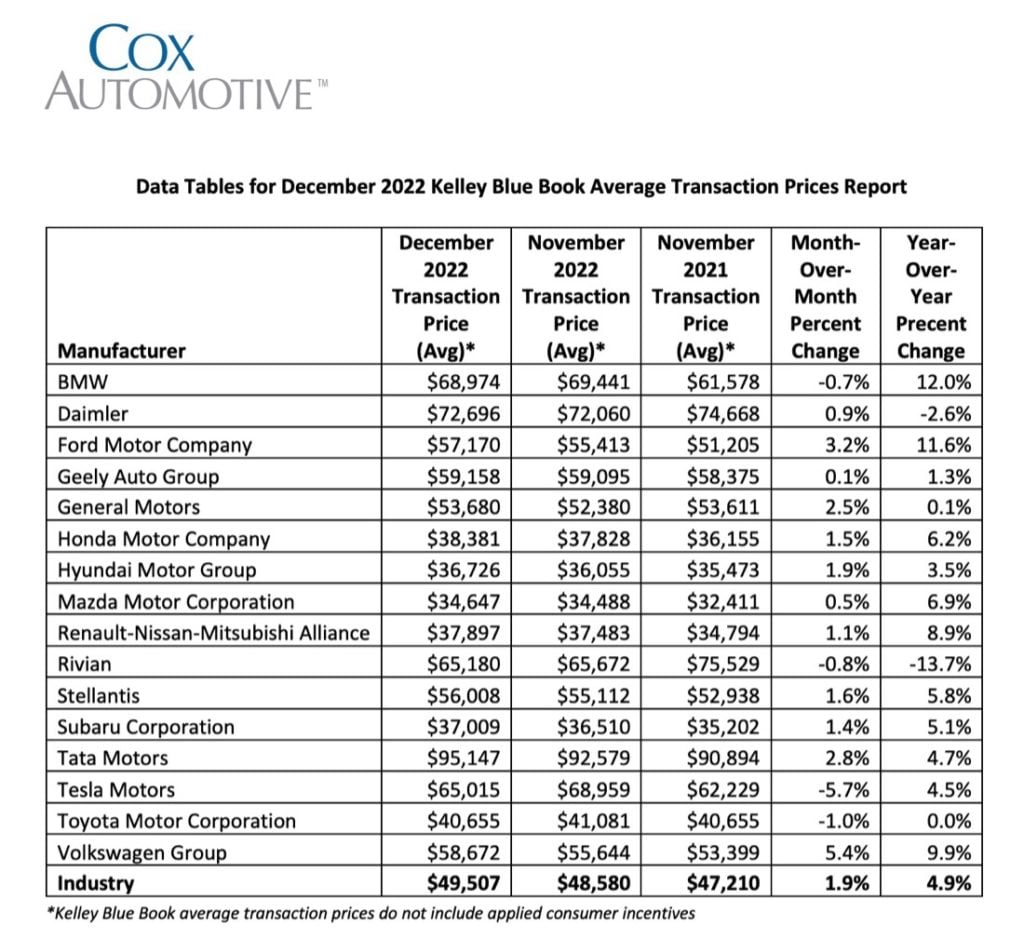

New vehicle sales are projected to increase a bit, but most of that will be due to increased fleet and commercial sales. While prices for non-fleet new vehicles are coming down, they’re still elevated. According to Kelley Blue Book, new car prices have increased 32% in three years, leaving Americans paying $10,000 more for a new car than they did in 2019. The average price paid for a new vehicle in December 2022 was a record $47,077, a $1,000 increase over November. And as of Q4 2022, 15.7% of all new car purchases had average monthly payments of over $1,000.

Walsh and Maxwell predict dealership consolidation and an aggressive certified, pre-owned market will continue. They also see dropping prices for EVs and dealers starting to restore incentivized purchases (such as rebates). And used car prices for most manufacturers increased over 2021, with Ford and BMW leading the pack.

Cars were a major factor contributing to inflation in 2021. As we move into 2023, while still looming, a recession has yet to materialize. But it will continue to impact inventory and demand. And while higher than they have been for several years, a 6.5% interest rate is far from the 21% rates sales veterans have seen in decades past.

Like so many others, the auto industry will never return to its pre-COVID modus operandi. As it returns to a version of normal, the dealers who didn’t get wrapped up in the euphoria of the last three years and remained disciplined, will not only thrive but change the face of the industry forever.

Ready to talk?

Want to navigate the new normal with a partner you can count on to help you accelerate sales, even in uncertain times?

Author: Lisa Walsh

Lisa is Executive Director of Automotive Solutions at MarketSource. She brings 35+ years of automotive experience to her role. Lisa has owned her own dealership, served as a dealership finance director and general manager, and was a business development manager at GM. In spearheading results for dealership fixed and variable operations as well as OEM accessory and fleet sales, her clients consistently achieve greater account growth, market share, customer retention, customer satisfaction, and more.